Custom Credit Repair

Real time updates

Unlock your financial potential

Increase your credit today, with expert credit repair services in Las Vegas Nevada

Awards and Recognition

"License and Bonded in the State of Nevada"

"Rebuild Your Credit, Reclaim Your Future"

Welcome to Boss-Credit, your trusted partner on the journey to better credit and financial stability. We understand that life’s unexpected twists can sometimes lead to credit challenges. But here’s the good news: with our expert credit repair services, you can take control of your credit score, open new doors of financial opportunity, and secure a brighter future.

At Boss-Credit, we adhere to strict ethical standards in our credit repair practices. We prioritize your interests and always act in accordance with the law. We are dedicated to transparency and will never make false promises or engage in unethical practices.

OUR SERVICES

CREDIT REPORT ANALYSIS

DISPUTE RESOLUTION

CREDIT BUILDING STRATEGIES

CREDIT COUNSELING

Why Choose

BOSS-CREDIT?

Why Choose BOSS-CREDIT?

Proven Track Record

Customized Solutions

Educational Resources

WHAT OUR CLIENTS SAY

Michael Johnson

Jennifer Martinez

David Smith

Lisa Rodriguez

Robert Davis

Jessica White

William Turner

Emily Brown

Christopher Taylor

Sarah Lopez

Daniel Adams

Amanda Scott

James Parker

Elizabeth Hall

John Clark

Melissa Garcia

Andrew Lee

Michelle Harris

Brian Lewis

Karen Martinez

Beyond Credit Scores

Join Our Social Media Family for a Deeper Dive into Credit Renewal, where Expert Advice, Success Narratives, and Personal Growth Collide!

We only charge when we successfully remove negative items from your credit report

Each item below is for each account/credit agency individually.

Collections $30

Charge-Offs $50

Repossessions $100

Bankruptcies $250

Inquiries $10

Late payments $50

Student loans $50

Evictions $50

Personal information FREE

Collections $30

Charge-Offs $50

Repossessions $100

Bankruptcies $250

Inquiries $10

Late payments $50

Student loans $50

Evictions $50

Personal information FREE

Per Bureau removed

Essential

perfect for fetting started on your credit journey

99

/ month

one-time start-up fee /

299

Unlimited disputes

Full credit report analisys

Personalized strategy

Real-Time Progress Updates

credit building Guidance

Monthly consultations

Smart credit report

29.95

/ mo

Required Must remain open to disputes with updates every 35 days

Premium

Maximun power for serious credit transformation

199

/ 6 month

One year service, start up fee /

499

Unlimited disputes

Letter disputes

Phone disputes

Online disputes

Priority credit report analysis

Aggressive dispute strategy

Real - time progress Updates

Dedicated Credit Specialist

Smart credit report

29.95

/ mo

Required Must remain open to disputes with updates every 35 days

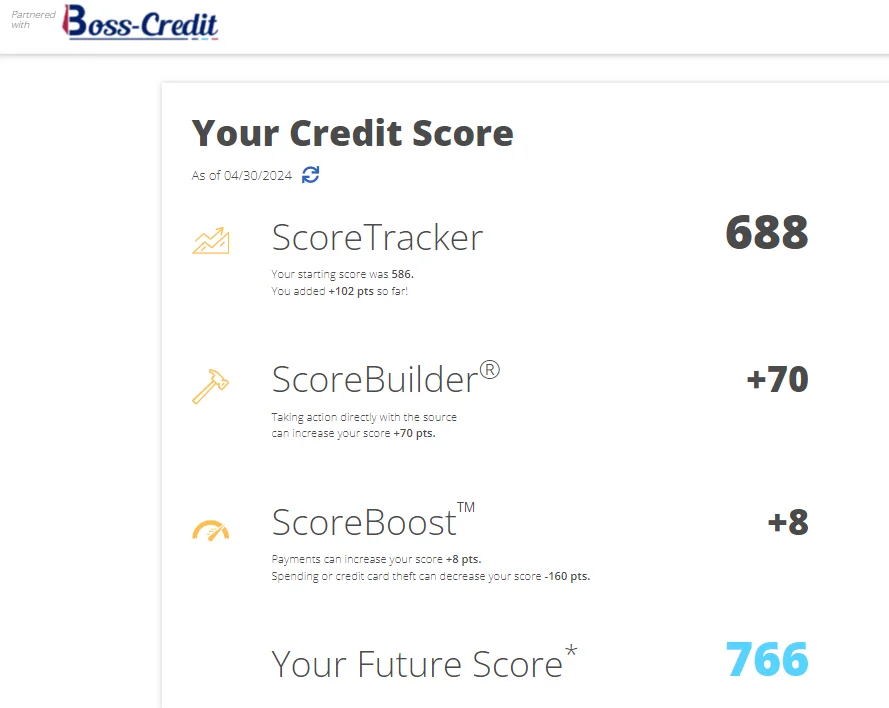

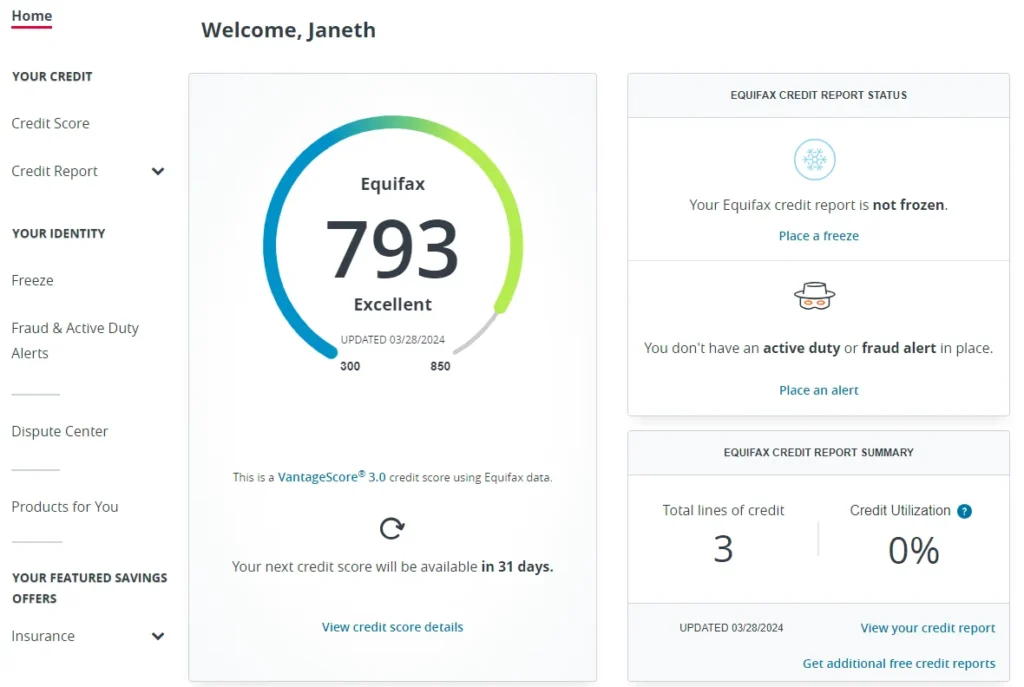

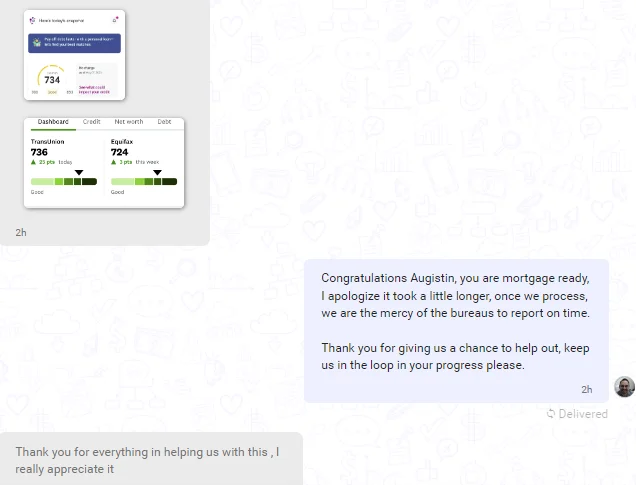

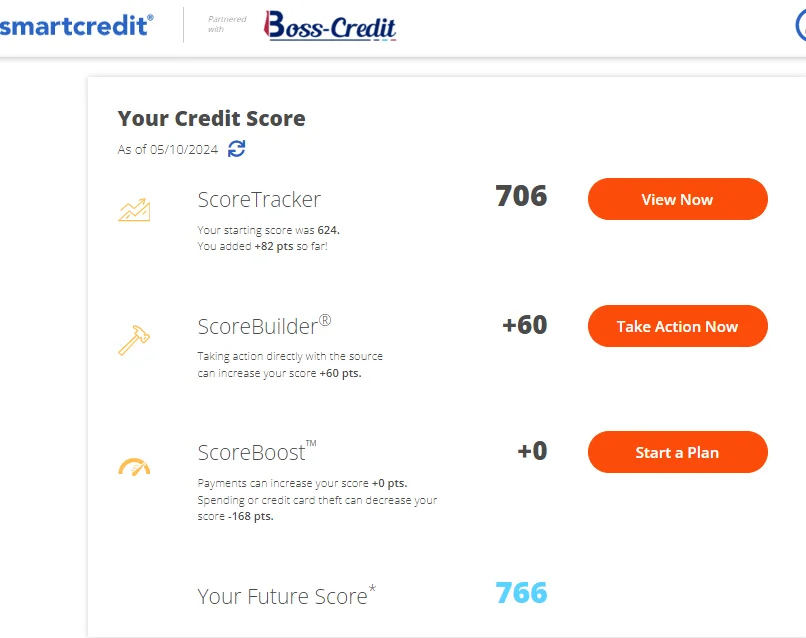

know the results that our customers have had

Look at the results that our clients have obtained

Are you ready to take control

of your financial future?

Are you ready to take control of your

financial future?